Betfair on X: "🤔 Should the FA hit Liverpool with a points deduction for Klopp's behaviour against Spurs? https://t.co/on0dpyQlIE" / X

Calculators Weapons of Math Deduction Funny 5 Panel Snapback Flat Visor Baseball Hat Black : Amazon.co.uk: Fashion

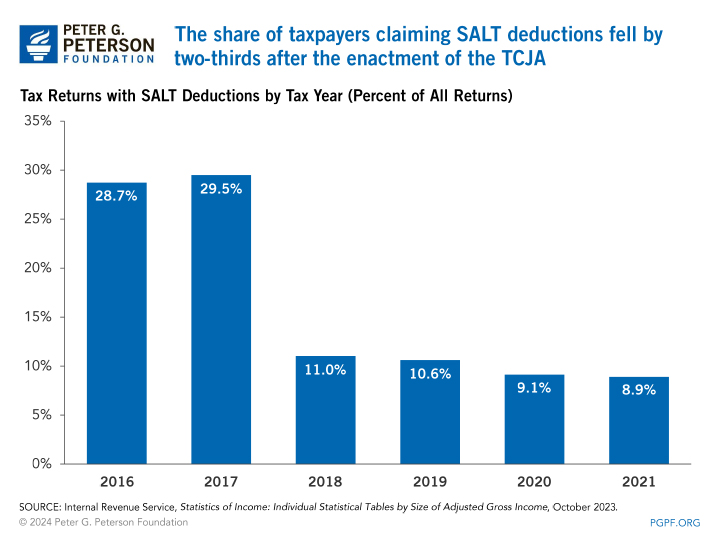

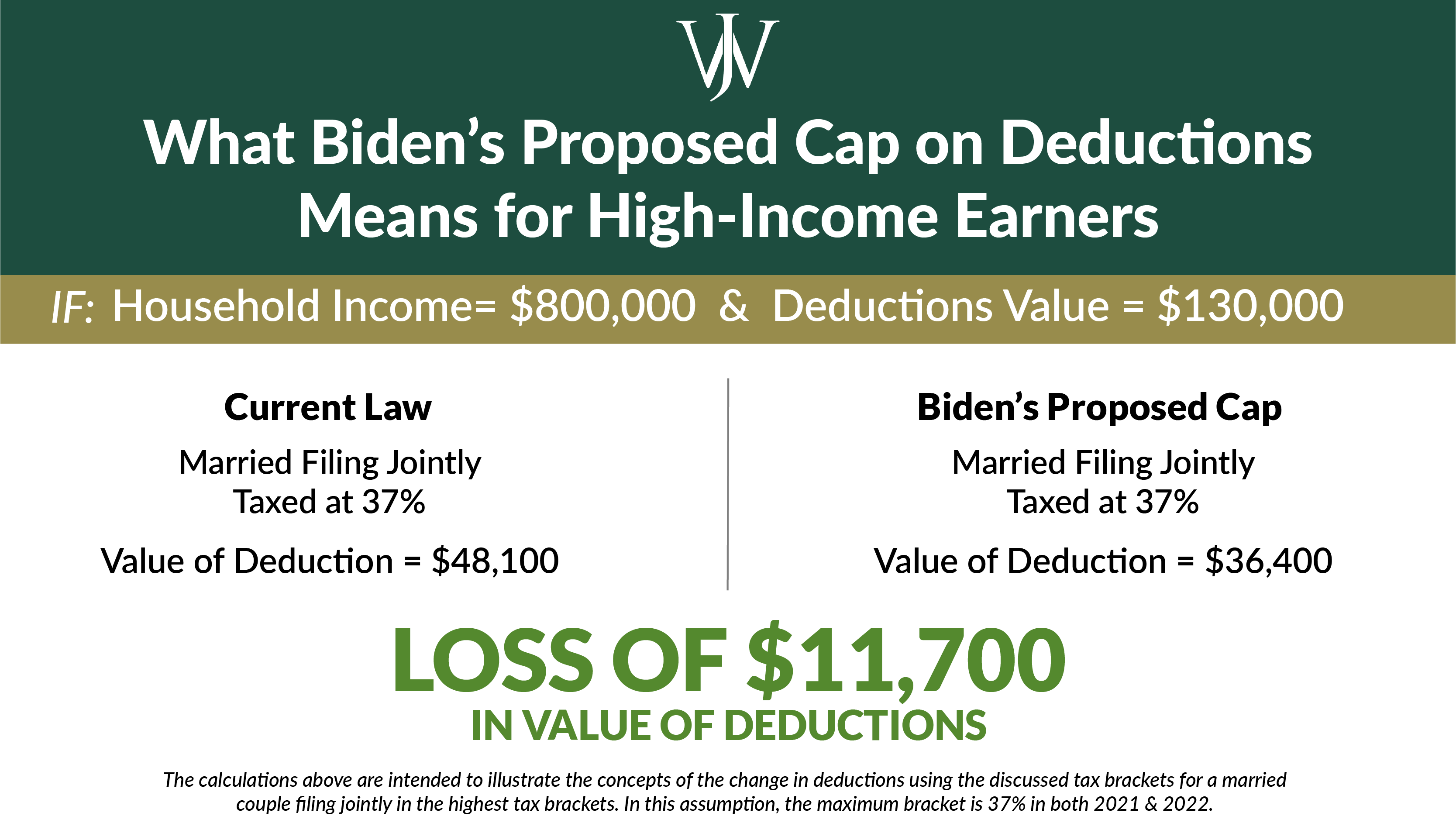

Repealing the Federal Tax Law's Cap on State and Local Tax (SALT) Deductions Is No Improvement – ITEP